Last Updated on March 28, 2025

- Lower interest rates

- Eligibility for high-reward, high-limit credit cards

- Easier approval on rentals and leases

- Easier qualification for a mortgage loan

- Ability to tap home equity through HELOCs and home equity loans

- More negotiating power

- Better car loans and lower car insurance rates

- Fewer security deposits on services and utilities

- Easier job hunting

- Achieving Good Credit

- Good Credit = More Options

More and more consumers are finding themselves in the “excellent” or “good” credit categories every year. In fact, the average American FICO score is at an all-time high (704 as of last September), while 21% of the population now has a “super-prime” credit score (over 800 out of 850). Another 20% has a score between 750 and 799. Even though the idea of credit seems a bit frightening, the benefits of good credit are extremely significant.

Although these high credit scores come with certain bragging rights, they more importantly bring some serious financial advantages. Consumers with high credit scores have easier access to loans and credit cards. They enjoy lower interest rates and might even see lower insurance costs as a result.

Just ask yourself: is my credit score on the high end? If not, you should definitely work on getting there. Here are some huge advantages you’ll enjoy if you do:

Lower interest rates

Lower interest rates are one of the biggest perks of having a great credit score. With a high score, you’ll see lower rates on auto loans, car leases, mortgage loans, credit cards and more. If you finance furniture or other big-ticket purchases, you’ll enjoy lower rates on these as well.

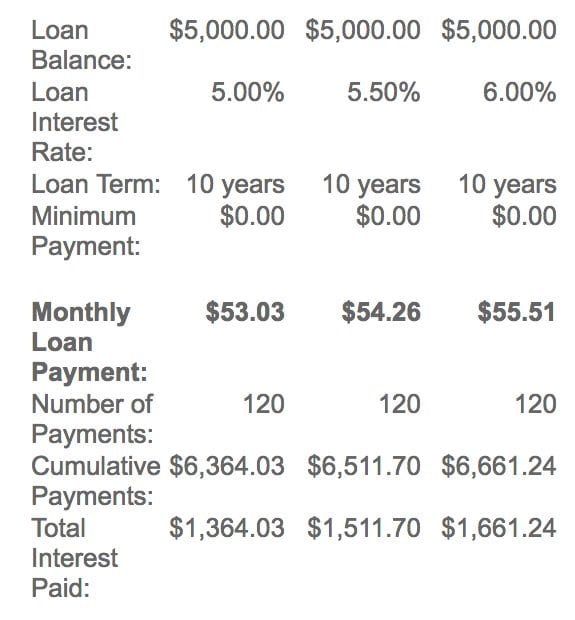

Lower interest rates, however, don’t just mean lower monthly payments. Depending on how big your purchase is — and how long you’ll be paying it off— a lower interest rate could amount to serious savings over time. On a $5,000 loan (see below), a 0.5% difference could mean hundreds of dollars saved by the end of the payment period.

Eligibility for high-reward, high-limit credit cards

The most coveted credit cards (ones that earn you cash back, give you airline miles or come with sky-high limits) are reserved for consumers in the upper echelon of credit — people who credit card companies know will pay off their debts and spend responsibly. Although this might not sound like a huge perk, it means an even bigger financial edge for those who can qualify for them. Other credit card options often only cost you money and give you nothing in return for your spending.

With that being said, high-credit consumers don’t just gain access to cards with big spending limits and valuable rewards programs. They can also qualify for any card — regardless of its terms or offerings — much more easily thanks to their good credit. More prized credit cards usually come with a lower interest rate too.

But how does one get a high limit credit card, and which credit cards offer the highest credit limits? Eligibility for these cards is often linked to credit history and income, but there is definitely a range of cards depending on your goals and personal situation.

Just remember, patience is a virtue. Applying for a credit card (or several) can hurt your credit score under the wrong circumstances, so it is far better to apply wisely if and when you can be more sure that your credit card application will be accepted.

If you are looking for faster returns and increasing the chances of doubling your digits, you can also try being part of a credit card affiliate program.

Easier approval on rentals and leases

Most landlords and property managers use credit reports to screen potential tenants. Overdue accounts, poor payment histories and low credit scores can all send red flags during the approval process. Will the tenant pay their rent on time? Can they be trusted to cover their utilities and care for the property? These concerns often cause a landlord to deny a potential renter’s application right off the bat.

Good credit, though? That gives landlords confidence in a tenant and their ability to pay their monthly obligations on time. It might even open doors to higher-end or more in-demand properties or co-ops, which often require board approval before a new tenant can move onto the property.

Easier qualification for a mortgage loan

When it comes time to buy a home, good credit really works in your favor. It can give you access to more loan options and lower interest rates, and it might even give you more negotiating power when it comes to fees and closing costs.

If you choose an FHA loan, the higher interest rates do come with a lower down payment. On these mortgages, a 10% down payment is required if you have a score under 580. Above this range, you can put down just 3.5% (or $7,000 on a $200,000 home).

Ability to tap home equity through HELOCs and home equity loans

Once you own a home, you may want to tap into its equity via a home equity loan or home equity line of credit (HELOC). These can give you cash to pay for renovations, repairs, medical bills, college tuition or any other expenses you might need to cover. The only catch? You usually need at least a 620 credit score to even be considered for these loans.

More negotiating power

In general, a higher credit score equals more negotiating power on just about any financial endeavor you set out on. You should aim for the highest credit score you can get. You have more leeway to negotiate with credit card companies, mortgage lenders, banks and other financial institutions on things like interest rates, repayment terms, APRs and other details of your accounts. This can help both lower your monthly payments/bills and save you in interest costs over time, which is a major win-win.

Better car loans and lower car insurance rates

Just like with any other kind of loan, it is absolutely the case that a better credit score will help with a car loan. While there is no hard and fast single credit score you need for a car loan, it is true (as of the last quarter of 2018) that the majority of car loans went to prime or super prime borrowers (those with credit scores of 661 and higher). Altogether, a better credit score improves your chances of qualifying for a car loan, paying a lower interest rate and buying a car without a cosigner.

Also, unless you live in Massachusetts, California or Hawaii, your credit score influences your car insurance costs. In all but these three states, auto insurers can use credit reporting data to set your premiums and annual charges. These insurance companies generally operate on the assumption that lower credit scoring-consumers file more claims and therefore require a higher premium. Those with higher scores are assumed to file fewer claims and are rewarded with lower premiums — even for the same amount of coverage.

Fewer security deposits on services and utilities

Good credit doesn’t just help you get into a home or rental property more easily; it can also save you initial move-in and utility set-up costs. Most landlords, utility providers and telecom companies require deposits for new occupants. These are designed to protect the provider’s financial interests and usually run anywhere from $100 to $500 depending on the service.

With higher-credit score consumers, providers and landlords are more likely to lower these deposits or, in some cases, waive them entirely. Put simply, high-scoring residents are considered to present less of a financial risk in the long-term.

Easier job hunting

Many employers use both background and credit checks as a part of their hiring practices. They might even run these checks before interviews are conducted. This means you won’t even get your foot in the door if your reports pull up unsavory info. Things like bankruptcies, poor payment history or open collections can all lead employers to question your abilities and deem you unfit for the position they’re hiring for.

Achieving Good Credit

Don’t have that top-notch credit score just yet? Don’t fret. There are plenty of ways to build that credit up. Be sure to take advantage of all the benefits a high score has to offer.

If you’ve never taken out a credit card or loan, you might not have a credit score at all. That’s OK. It’s actually easier to build good credit from scratch than to repair bad credit. Experts say it generally takes about six months to build a solid credit file up, so get started as soon as you can by opening a low-interest credit card, using it responsibly and paying off your balance month over month.

If you’re looking to repair a poor credit score, it might take a bit longer to recover. Bankruptcies and foreclosures stay on your credit report and public records for up to seven years, but other missteps can be recovered far quicker than that. If you’ve been late on payments or have accounts in collection, be sure to catch up on your bills. Contact the appropriate creditors to settle the collections efforts or set up a payment plan.

You should also:

- Set up automatic payments for bills to prevent any additional dings on your credit

- Pay down your debts, starting with the highest-interest ones first

- Avoid opening any new accounts or making big-ticket purchases

- Pull your credit report and notify the credit bureau of any errors you find

Once you’ve paid off a card or account, don’t close it. Account history plays a big role in your score. Having a long-standing account on your record can only help your score — not hurt it.

Good Credit = More Options

As you can see, having great credit comes with some serious advantages. But most importantly, it means more financial options. You can buy a home, leverage high-reward credit cards and enjoy better job and rental opportunities as a result. And to top it all off, the lower interest rates mean you can accumulate more savings, which are ultimately the key to getting you where you want to be financially.

- Top 10 Ways on How to Pay Off Credit Card Debt

- Top 6 Debt Payoff Planner Apps to Help You Tackle Debt

- How to Save At Least $100 Every Month

This article is part of the “Debt Payoff Series.” Click here to learn more.

Aly J. Yale is a freelance writer and journalist from Houston, covering real estate, mortgage, and finance topics. Her work can be seen in Forbes, The Balance, The Mortgage Reports, MReport, DS News, and The Simple Dollar. She previously served in editorial and production capacities for news organizations such as The Dallas Morning News, NBC, Radio Disney, and PBS.

- Aly Yalehttps://successiblelife.com/author/aly-yale-journalist-freelance-writer/

- Aly Yalehttps://successiblelife.com/author/aly-yale-journalist-freelance-writer/

- Aly Yalehttps://successiblelife.com/author/aly-yale-journalist-freelance-writer/

- Aly Yalehttps://successiblelife.com/author/aly-yale-journalist-freelance-writer/